richmond property tax rate 2021

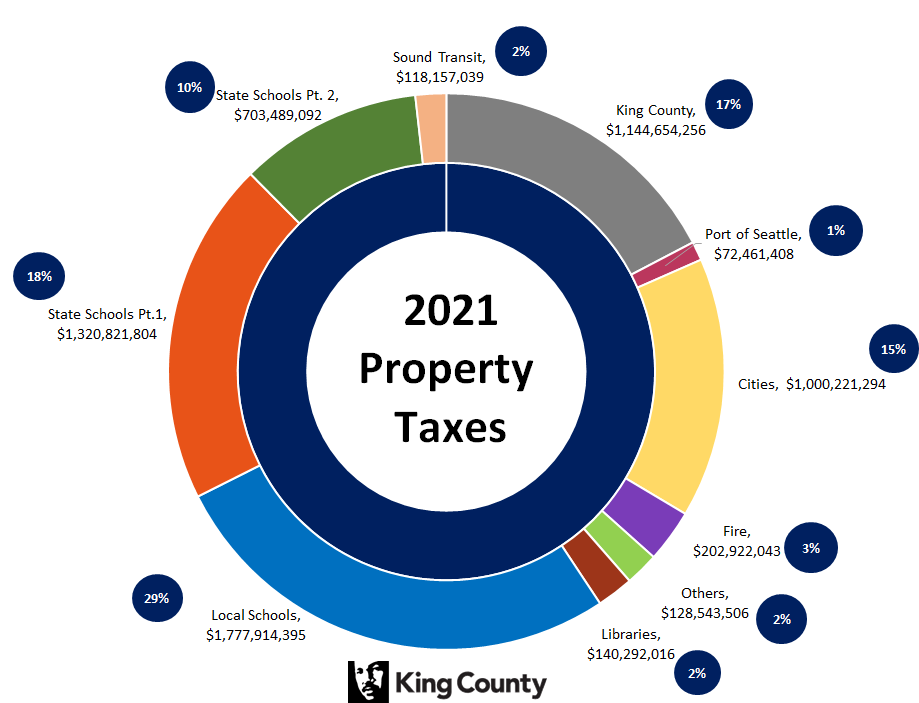

NO -NEW-REVENUE TAX RATE 0670300 per 100 VOTER -APPROVAL TAX RATE 0630392 per 100 DE MINIMIS RATE 0745750 per 100 The no-new-revenue tax rate is the tax rate for the. The rates of several taxing authorities usually combine to make up your total tax bill.

28 Key Pros Cons Of Property Taxes E C

Depending on your vehicles value you may save up to 150 more because the city is freezing the rate.

. Richmond Taxes City of. Car Tax Credit -PPTR. Get Record Information From 2022 About Any County Property.

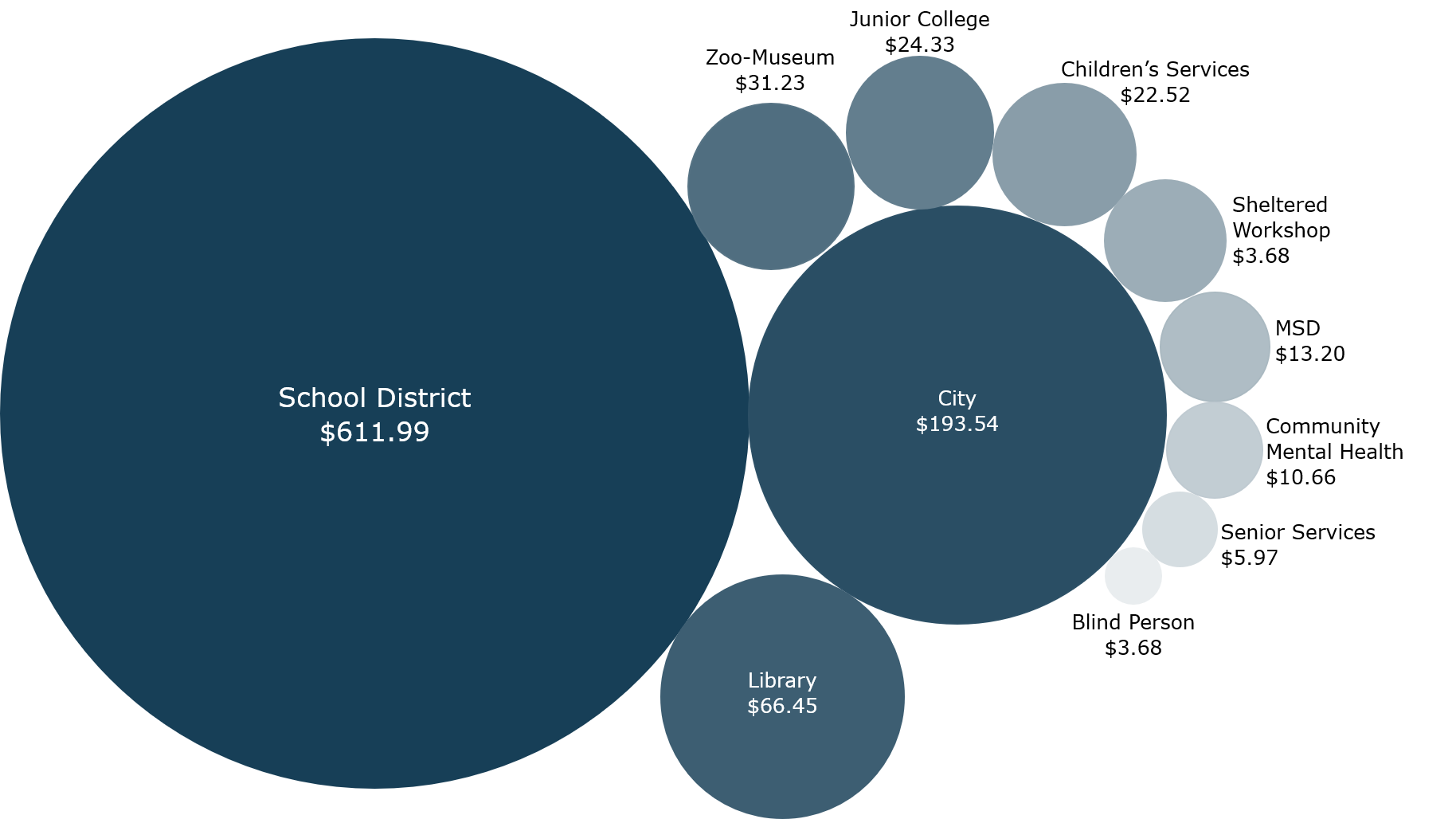

RICHMOND CITY OF TAX. Understanding Your Tax Bill. How are residential property taxes divided.

Province of BCs Tax Deferment. The personal property taxes estimates are 176 per 100 assessment. The residential tax bill is divided as follows.

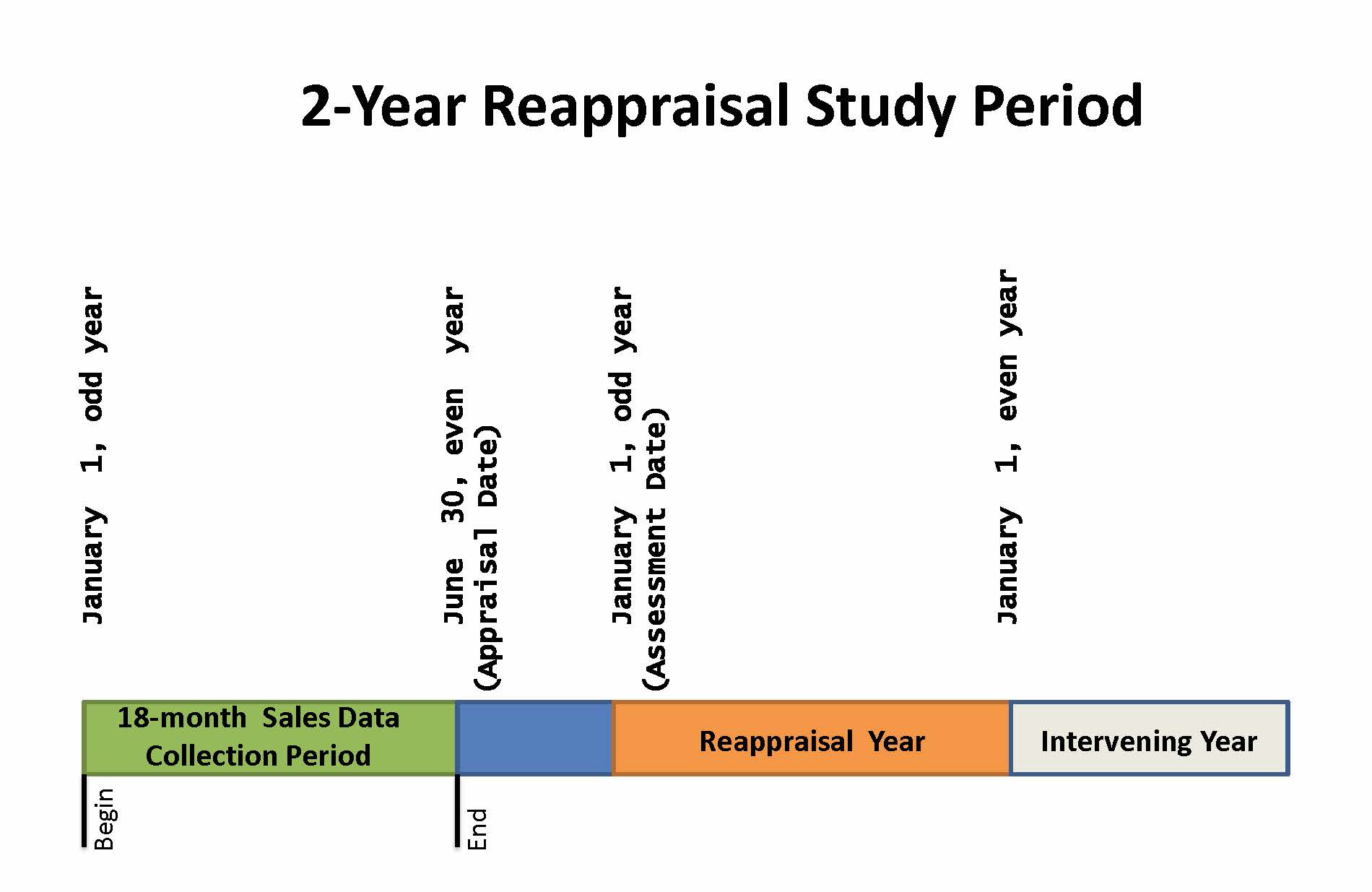

Manage Your Tax Account. The new assessments will be used to calculate tax bills mailed to city property owners next year. For information and inquiries regarding amounts levied by other taxing authorities please contact.

These agencies provide their required tax rates and the City collects the taxes on their behalf. According to city officials taxation of real estate property are at a proposed rate of 129 per 100. Tax bills are mailed out on July 1st and December 1st and are due on September.

Real estate taxes are due on January 14th and June 14th each year. This year the city chose to select the compensating rate for the 2021 rates. Paying Your Property Taxes.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. The rates will be adjusted for 163 cents on each 100 of personal property and 134 cents on. Real property consists of land buildings and.

Tax District 001 Urban 339240. Whether you are already a resident or just considering moving to Richmond County to live or invest in real estate estimate local property. Richmond Hill accounts for only about a quarter of your tax bill.

Property Taxes AND Flat Rate Annual Utilities. It is estimated that by freezing the rate the city will provide Richmonders more than 8. Residential Property Tax Rate for Richmond Hill from 2018 to 2021.

The fiscal year 2021 tax rates are. What is the due date of real estate taxes in the City of Richmond. Ad Uncover Available Property Tax Data By Searching Any Address.

Millage Rates 2021 Net Millage Rates are as follows. Learn all about Richmond County real estate tax. Richmond Hill - 27 per cent of.

Ad Find County Online Property Taxes Info From 2022. Due Dates and Penalties for Property Tax. 2022 Tax Rates.

We Provide Homeowner Data Including Property Tax Liens Deeds More. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. Tax Rate per 100 of assessed value Albemarle County.

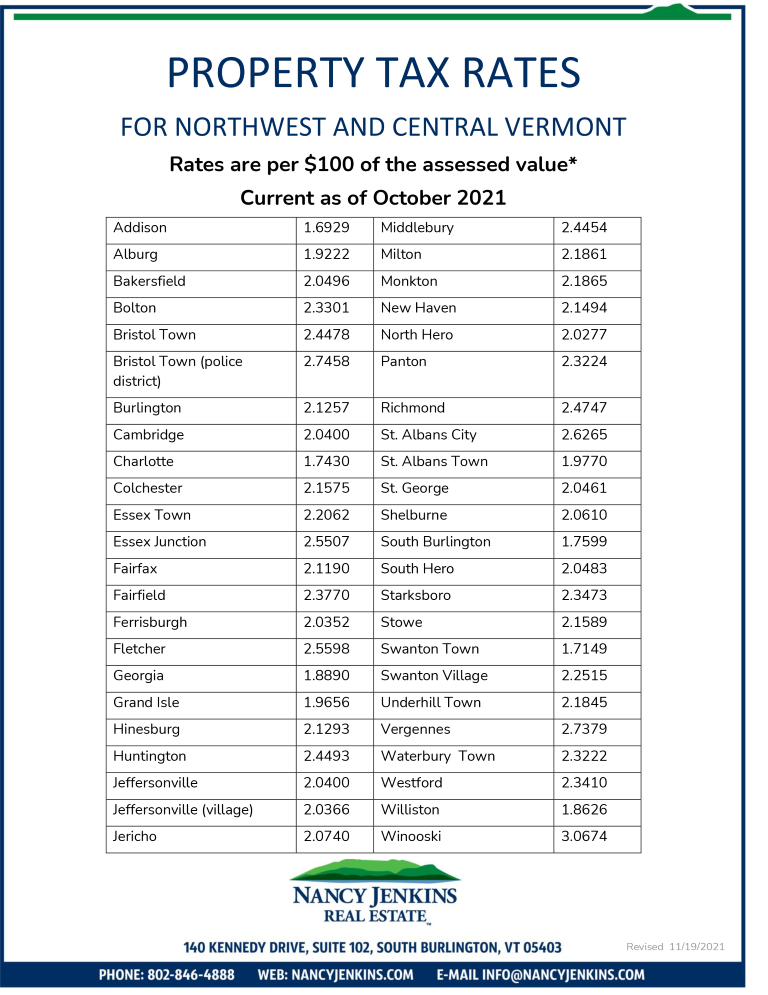

What is the real estate tax rate for 2021. This information pertains to tax rates for Richmond VA and surrounding Counties. Year Municipal Rate Educational Rate Final Tax Rate.

Vermont Property Tax Rates Nancy Jenkins Real Estate

Many Left Frustrated As Personal Property Tax Bills Increase

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

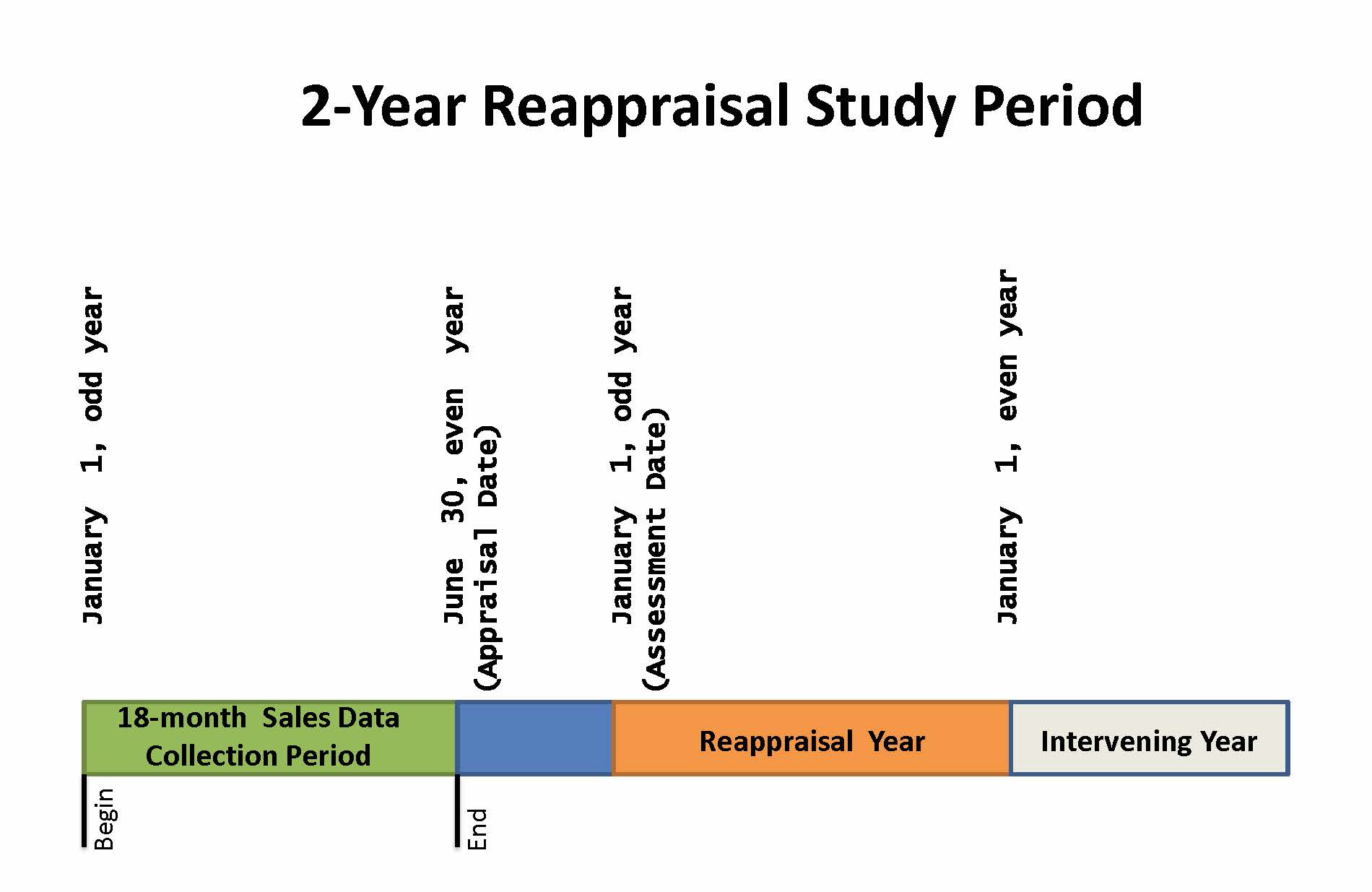

Property Assessment Process Adams County Government

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Ontario

Why Are Texas Property Taxes So High Home Tax Solutions

Property Tax Appeal Tips To Reduce Your Property Tax Bill

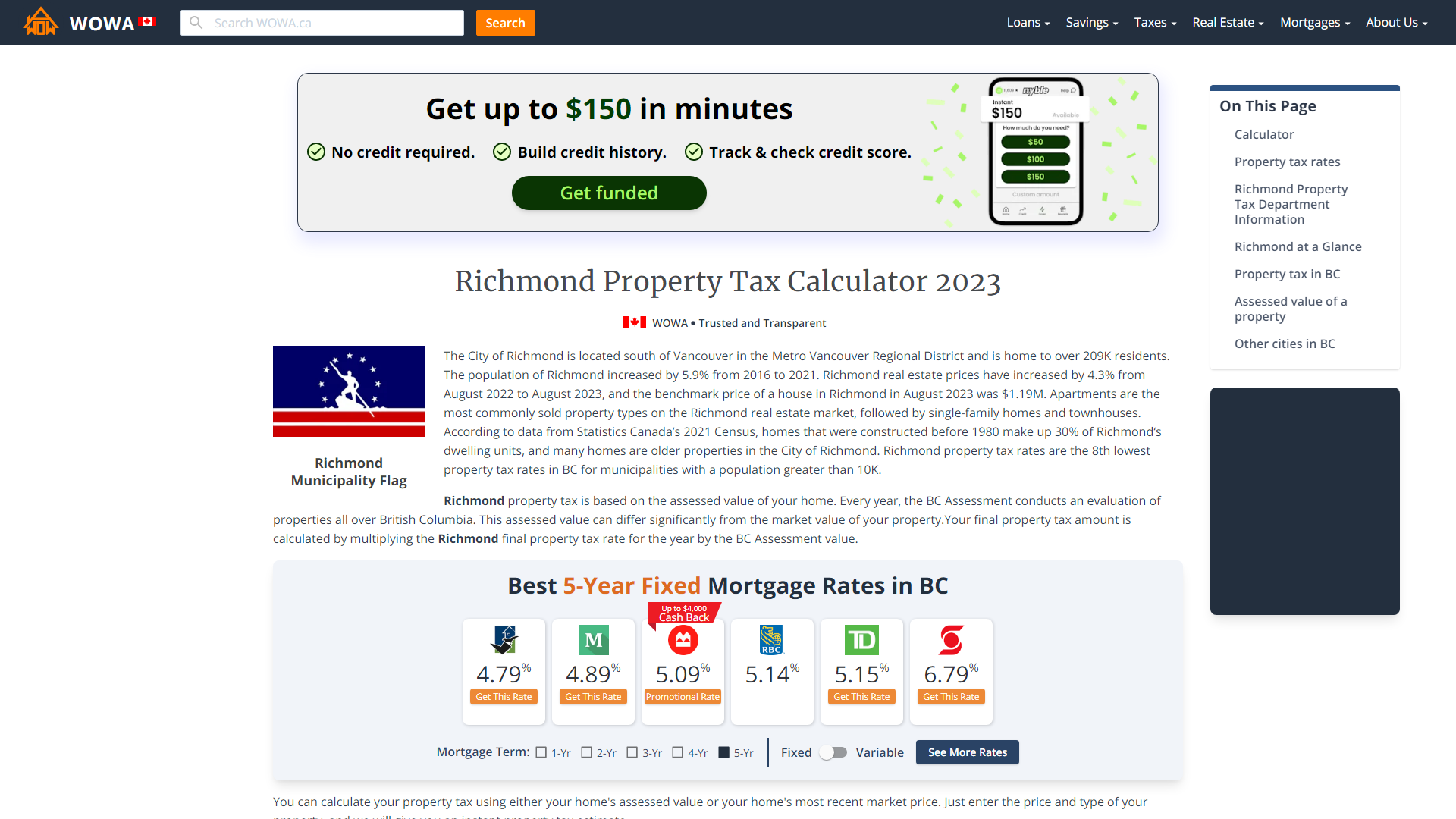

Richmond Property Tax 2021 Calculator Rates Wowa Ca

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Pay Online Chesterfield County Va

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Paying Your Property Tax City Of Terrace

Alameda County Ca Property Tax Calculator Smartasset

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

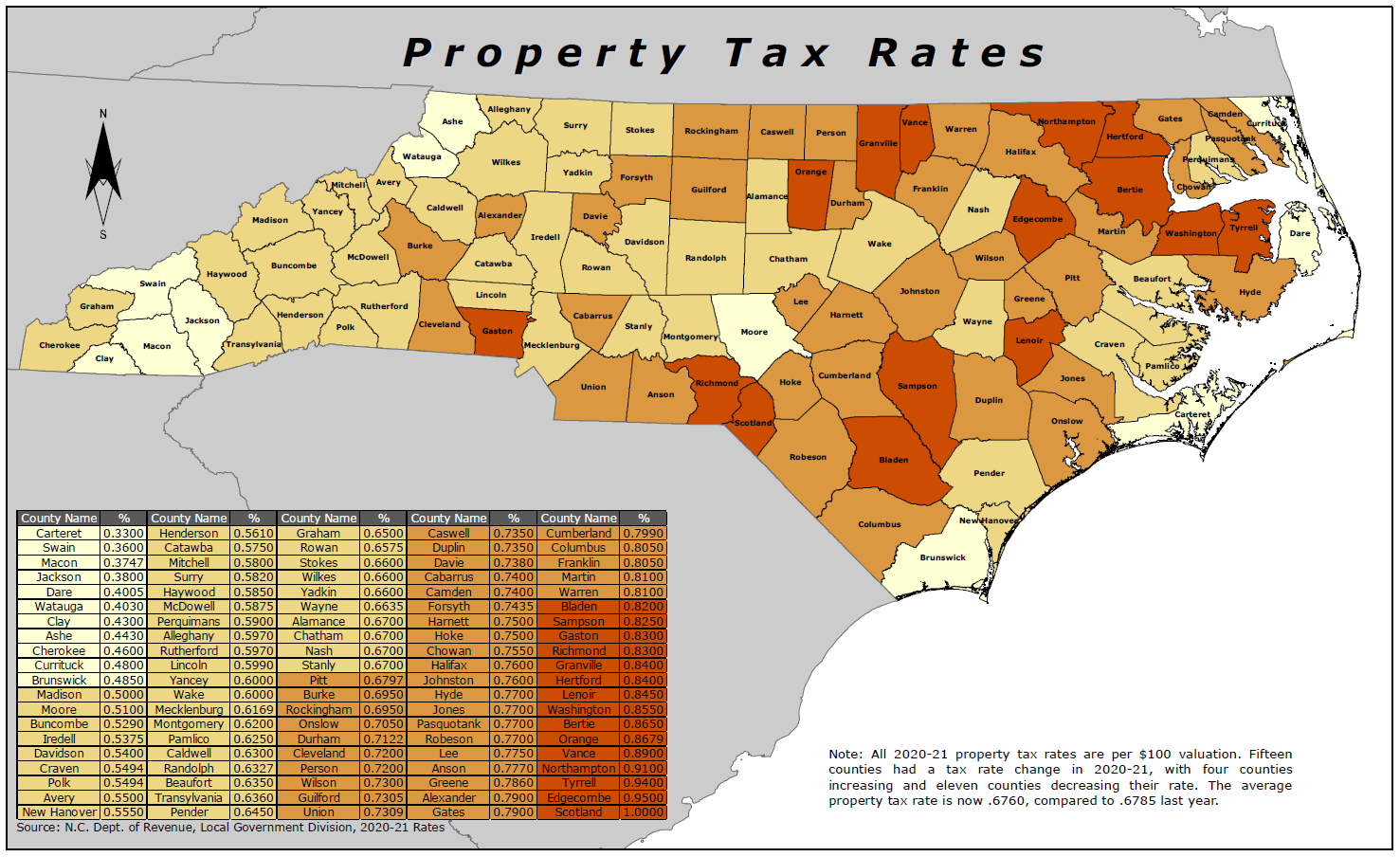

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate